extension of anti-dumping duty on imports of rubber in philippines

Intervention 60140: EU: Extension of antidumping duty

On 28 October 2015, the European Commission extended the definitive anti-dumping duty imposed on imports of the subject good from China including Chinese Taipei as well as Indonesia, Sri Lanka and the Philippines following the conclusion of the above sunset review, see related interventions.

Send Inquiry

EU: Extension of antidumping duty on imports of certain

On June 5th, 2008, the European Commission announced the initiation of a sunset review of the anti-dumping duty imposed on imports of tube or pipe fittings (other than cast fittings, flanges and threaded fittings) of iron or steel (not including stainless steel), with a greatest external diameter not exceeding 609.6mm, of a kind used for butt-welding or other purposes, fromThailand and China including Chinese Taipei, and extended to imports from Indonesia, Sri Lanka and the Philippines ...

Send Inquiry

Tariff agency reviews extension of dumping duty on Turkish

MANILA, Philippines — The Tariff Commission (TC) is reviewing whether the anti-dumping duty on Turkish flour should be extended for five years as requested by local flour millers.

Send InquiryEU: Extension of definitive antidumping duty on imports

European Commission, Commission Implementing Regulation (EU) No 2015/776 (18.05.2015), extending the definitive anti-dumping duty imposed by Council Regulation (EU) No 502/2013 on imports of bicycles originating in the People's Republic of China to imports of bicycles consigned from Cambodia, Pakistan and the Philippines, whether declared as originating in Cambodia, Pakistan and the Philippines or not, Official Journal of the European Union, 19.05.2015, L 122, from p.

Send Inquiry

5-year extension of dumping duty sought. - Free Online Library

The Philippine Anti-Dumping Law (Republic Act 8752) requires that a petition for extension be filed at least six months before expiry date. PAFMIL claims that there exists a need to extend the dumping duty on Turkish flour due to the likelihood of recurrence of dumping and again becoming a threat to the local industry which is still recovering from losses caused by dumped Turkish flour in the past.

Send Inquiry

PAFMIL asks for extension of Turkish flour anti-dumping duty

Under Republic Act 8752, or the Anti-Dumping Act of 1999, a petition for extension should be filed six months before expiration. The TC imposed an anti-dumping duty of up to 16.19% on Turkish flour on Jan. 8, 2015 after it considered to be a threat to local manufacturers. The levy is due to expire after five years or on Jan. 8, 2020.

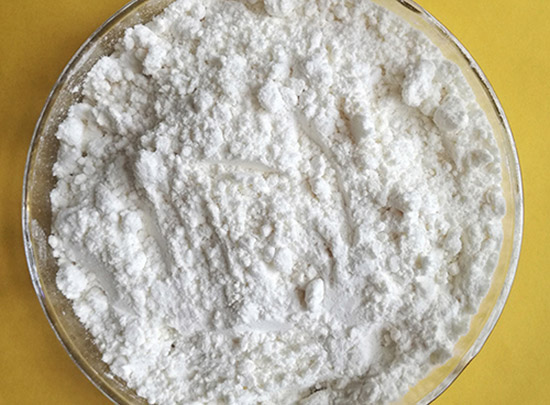

Send InquiryCBEC imposes Anti-Dumping Duty On Rubber Chemical PX-13

Rubber Chemical MOR –. There was continued dumping of MOR from China PR. Imports were significantly undercutting and underselling the prices of the domestic industry. Cessation of anti-dumping duty was likely to lead to continuation and recurrence of dumping and injury to the domestic industry.

Send InquiryAustralia: Extension of antidumping and countervailing

Australia: Extension of antidumping and countervailing duty on imports of certain aluminium extrusions from China and from certain exporters from Chinese Taipei, Thailand and Malaysia following an anti-circumvention investigation

Send InquiryIndia: Extension of antidumping duty on imports of certain

On October 20, 2011, the Indian authorities issued the notification of extension of the anti-dumping duty imposed on imports of rubber chemicals MBT, MBTS, CBS and PVI from China (Notification No. 98/2011-Customs, 20.10.2011). The amount of the duty is USD 0.23 per kilogram. This duty is effective for a period of five years.

Send InquiryChina extends anti-dumping duties on imported rubber for 5

The MOC said anti-dumping duty rates for Japanese imports range from 10.2 percent to 43.9 percent, while those for U.S. producers are 151 percent and European companies are subject to rates ranging from 11 to 151 percent. Chloroprene rubber, commonly known as Neoprene, is mostly used to manufacture electrical cables and waterproof products.

Send InquiryAnti-Dumping Duty Definition

Anti-dumping duty is a protectionist tariff that a government places on imports thought to be significantly underpriced.Governments cannot normally determine what constitutes a fair market price for any good or service. Practical Examples of Anti-Dumping Measures.

Send InquiryIndia: Further extension of antidumping duty on imports

On October 8, 2007, the Indian Directorate General of anti-dumping & allied duties, Ministry of Commerce & Industry, initiated a second sunset review of the anti-dumping duty imposed on imports of acrylonitrile butadiene rubber NBR from Germany and South Korea. The products subject to

Send Inquiry

EU stamps on shoe imports with extension of anti-dumping duties

The EU yesterday renewed punitive anti-dumping duties on Chinese and Vietnamese shoe imports for two years just as Peter Mandelson, the EUHe welcomed the decision, taken by EU ambassadors and to be rubber-stamped by ministers today, to renew the duties on Chinese and Vietnamese

Send Inquiry

What is anti-dumping duty? definition and - BusinessDictionary.com

Definition of anti-dumping duty: A penalty imposed on suspiciously low-priced imports, to increase their price in the importing country and so protectAnti-dumping duties are assessed generally in an amount equal to the difference between the importing country's FOB price of the goods and (at

Send Inquiry

Anti-Dumping Duty Explained - Shippo

We’ve spoken about UK Duties and Taxes a lot on this blog; they’re one of the largest costs in the importing process and, if you aren’t aware of them, they’re the ones that will catch you completely off-guard.

Send InquiryAnti-dumping duty on imports of certain rubber - Lexology

Anti-dumping duties in force can be extended only if Customs Notification levying anti-dumping is in existence.First proviso of Section 9A(5) of the Customs Tariff Act provides for the extension of anti-dumping duty for a further period of five years if there is likelihood of continuation or recurrence

Send Inquiry

Anti-Dumping Duty investigation for Polybutadiene Rubber Import

Subject: Initiation of Anti-Dumping Duty investigation concerning imports of “Polybutadiene Rubber or PBR” originating in or exported from Korea PRand Collection of Anti-Dumping Duty on Dumped articles and for Determination of injury) Rules, 1995 as amended from time to time (hereinafter

Send InquiryGovt may impose anti-dumping duty on Chinese synthetic rubber

Commerce ministry's investigation arm Directorate General of Trade Remedies said imposition of the duty on imports of 'fluoroelastomers' from"The authority considers it necessary to recommend imposition of definitive anti-dumping duty on importsfor 18 months," DGTR said in a notification.

Send Inquiry

Anti-Dumping Duty - Overview, How to Calculate, and Examples

Anti-dumping duty is a tariffTariffA tariff is a form of tax imposed on imported goods or services. Tariffs are the common element in international trading.The American businesses complained that the large imports of steel resulted in unfair competition since the imports were unfairly low.

Send Inquiry

Anti-dumping duty likely on Chinese chemical imports - Times of India

It has recommended "imposition of definitive anti-dumping duty" for a period of five years to remove the injury to the domestic industry. Himadri Speciality Chemical had filed the application for initiation of anti-dumping investigations. While DGAD recommends the duty, the Finance Ministry imposes it.

Send Inquiry